We have a strict honesty policy, but please note that when you buy through our links, we may earn a commission. Learn more.

In this post, we take a detailed look at Shopify POS pricing — and help you work out which of its POS plans makes the most sense for your business. We also cover other key Shopify POS system costs including credit card fees and hardware costs.

Shopify POS Pricing: understanding the plans

While many ecommerce competitors only let you use POS on their more expensive pricing plans, Shopify POS is available to all Shopify users — which means that you can access it for as little as $5 per month via Shopify’s entry-level ‘Starter’ ecommerce plan.

This built-in version of Shopify POS is called ‘Shopify POS Lite’; and there’s also a premium version available, ‘Shopify POS Pro.’

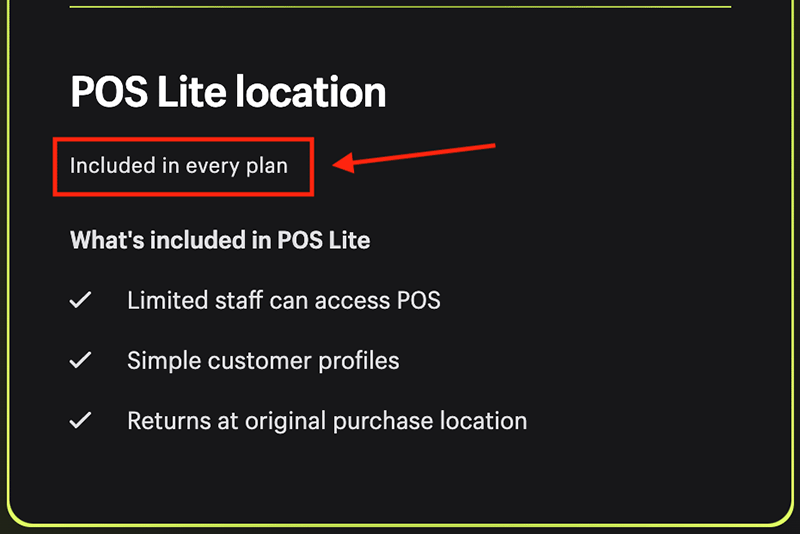

Shopify POS Lite pricing

Shopify ‘POS Lite’ is the basic version of Shopify’s POS system that all Shopify users get access to as part of their subscription.

It lets you take in-person payments for goods with the Shopify POS app, create customer profiles and use the full range of Shopify POS hardware (such as card readers, barcode scanners and receipt printers — more on Shopify POS hardware shortly).

Shopify ‘POS Lite’ also lets you:

- track inventory

- accept ‘tap to pay with iPhone’ payments

- issue refunds

- accept returns at the original purchase location

- use multiple locations to store inventory (‘Basic’ plans and higher)

- accept cash payments for sales when you are offline

- sell and accept gift cards

- accept split payments, partial payments or tenders.

Now, since POS Lite comes bundled with Shopify’s standard plans, your Shopify store subscription is the only initial cost you’ll encounter when using it.

Shopify’s four standard subscriptions are as follows:

- Starter — $5 per month

- Basic — $39 per month

- Grow — $105 per month

- Advanced — $399 per month

(A 25% discount on the ‘Basic,’ ‘Grow’ and ‘Advanced’ plans is available if you pay for your first year’s service upfront — doing so brings the costs of these three plans down to $29, $79 and $299 per month respectively.)

Now, although Shopify ‘POS Lite’ is included on the $5 per month ‘Starter’ plan, it should be noted that there are two key drawbacks to the POS features on this plan.

First, only one user can log in to your Shopify POS account on this plan.

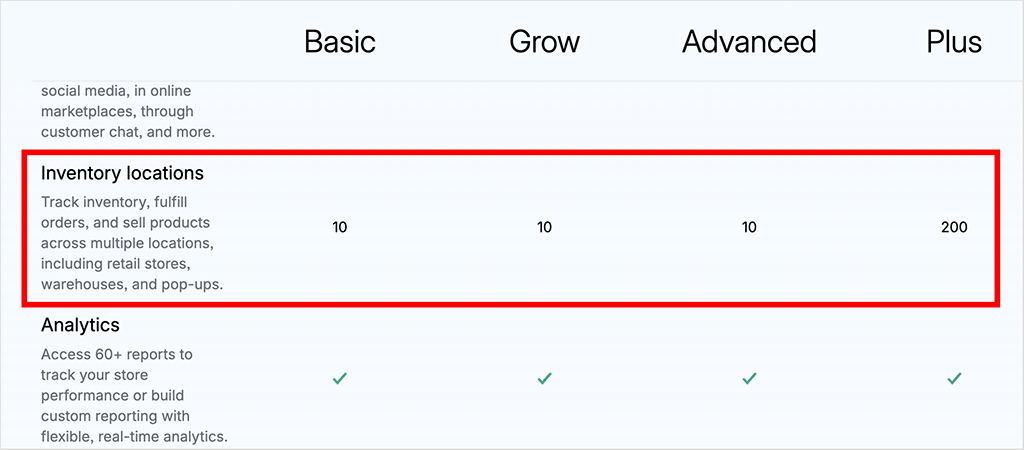

And second, you can only work with 2 inventory locations on the ‘Starter’ plan. By contrast, Shopify’s more expensive plans all permit you to work with up to 10 inventory locations.

(Shopify’s enterprise plan, ‘Shopify Plus’ increases this limit to 200.)

So, to get the full benefits of Shopify’s POS Lite features, you’ll realistically need to be on a ‘Basic’ Shopify store plan or higher.

Shopify POS Lite credit card fees

To use Shopify ‘POS Lite’ to sell in person, you’ll need to hook your Shopify account up to a ‘payment gateway’ — a service that processes credit card transactions.

Now, Shopify provides its own payment gateway service — ‘Shopify Payments’ — which is available in 39 countries, including the US, the UK, Australia, New Zealand, Canada, Hong Kong SAR, Japan, and much of the EU.

If you use Shopify Payments, the following credit card fees will apply on each in-person sale:

- Starter — 5% + 0¢ USD

- Basic — 2.6% + 10¢ USD

- Grow — 2.5% + 10¢ USD

- Advanced — 2.4% + 10¢ USD

If you use a third party-payment gateway, the credit card fees will vary by provider. So, you will have to do some sums and work out which approach is the most cost-effective option for you.

One thing worth pointing out though is that it’s generally much easier to use Shopify Payments as your payment gateway than working with a third-party one — there’s no complicated application or configuration process to worry about.

How to access Shopify POS Lite

Trying out Shopify POS Lite is easy — you just start a free Shopify trial. This will give you access to all the Shopify POS Lite features.

Is Shopify POS Lite right for me?

Shopify’s bundled ‘POS Lite’ plan offers quite a lot of POS functionality for very little additional cost.

Its payment processing, inventory tracking and sales management features are ideal for merchants who make occasional in-person sales at markets, pop-up shops and events.

(You can learn more about Shopify ‘POS Lite’ here.)

However, when using ‘POS Lite’ with the four main Shopify store plans mentioned above, you miss out on some key functionality:

- You can only sell in one single location at a time.

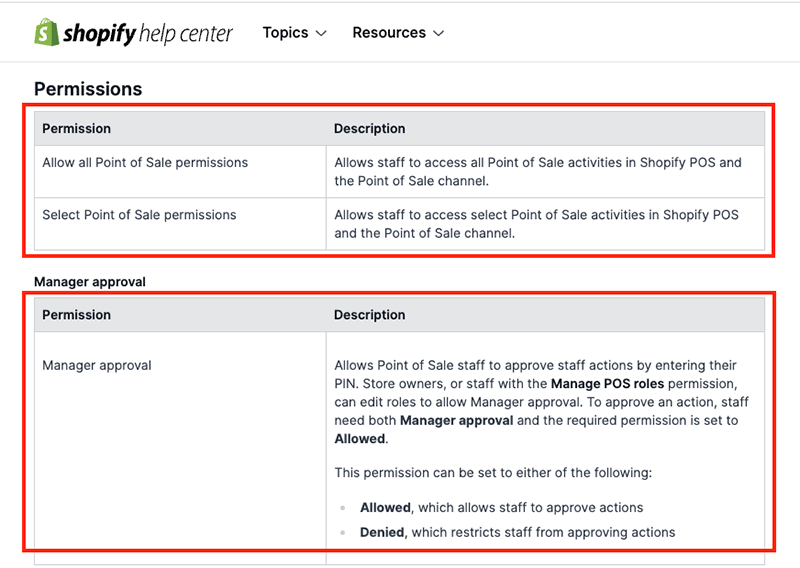

- You don’t have the ability to define staff roles and permissions.

- You can’t attribute sales to individual staff members.

So for Shopify businesses that operate using multiple stores, have large sales teams, or reward staff with commission, an upgrade to Shopify’s retail ‘POS Pro’ plan will be required.

So, let’s take a look at at that.

ℹ️ According to a recent EY report entitled ‘Future Proofing Retail‘, Shopify POS provides a 20% faster implementation time compared to competitors, thanks to streamlined setup and intuitive staff training, enabling quicker store openings and supporting retail network expansion. Additionally, its native omnichannel features — such as endless aisle, buy online pick up in-store (BOPIS), and integrated email capture — contribute to an 8.9% average annual sales uplift, helping retailers convert more sales, collect valuable first-party customer data and accelerate revenue growth.

Shopify POS Pro pricing

‘POS Pro’ is Shopify’s full retail point-of-sale solution for brick and mortar businesses.

It provides a wide range of advanced POS features on top of what’s already available in the ‘POS Lite’ plan discussed above.

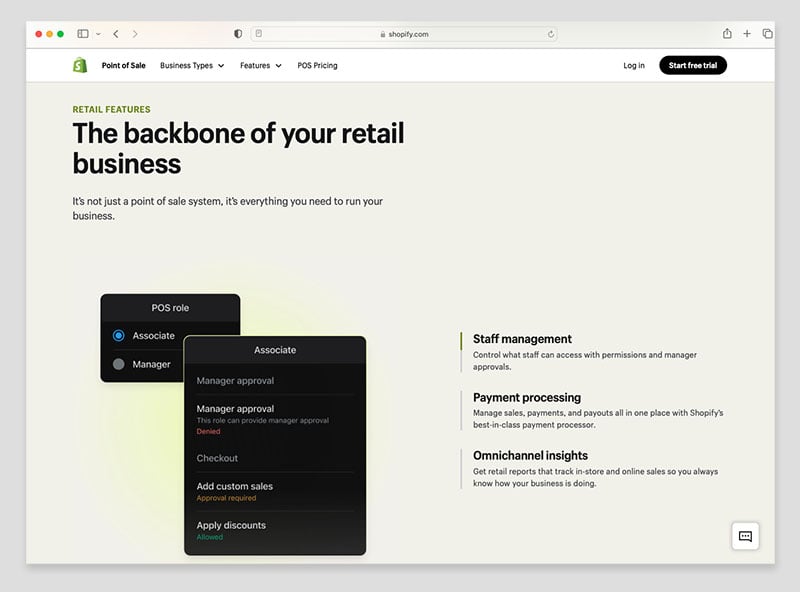

Crucially, these include the ability to set staff roles and permissions, track staff performance and attribute sales to individual staff members.

Furthermore, unlike Shopify ‘POS Lite’ — which staff access through your main Shopify admin — ‘POS Pro’ lets you create unlimited ‘POS-only’ staff roles.

This means you can give your sales staff access to the POS sales channel for transacting in-person sales in your store — but other key areas of your Shopify store account will be off limits to them.

Additionally, Shopify ‘POS Pro’ allows you to work with an unlimited number of store staff. By contrast, Shopify ‘POS Lite’ caps staff members according to the number of ‘seats’ provided by your Shopify plan.

The ‘POS Pro’ plan also lets you:

- facilitate exchanges

- provide custom printed receipts

- create purchase orders

- apply automatic discounts

- view low stock warnings

- provide local pickup options.

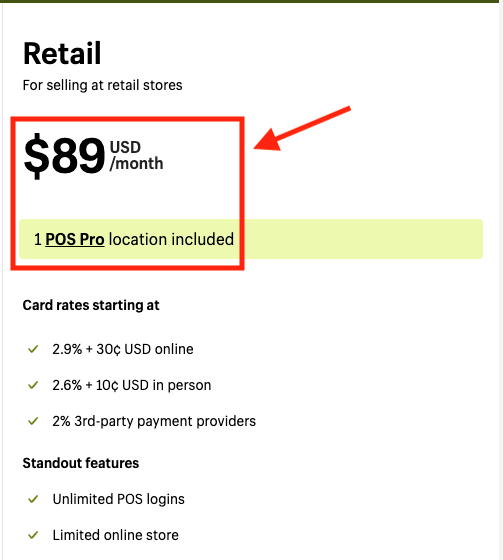

The fee for using Shopify ‘POS Pro’ with Shopify’s ‘Basic,’ ‘Grow’ and ‘Advanced’ plans is $89 per month, per location.

However, Shopify provides an 11% discount if you pay upfront for an annual Shopify ‘POS Pro’ subscription, which brings your monthly charge down to $79 per month.

Additionally, further savings on Shopify’s ‘POS Pro’ offering are available for enterprise customers.

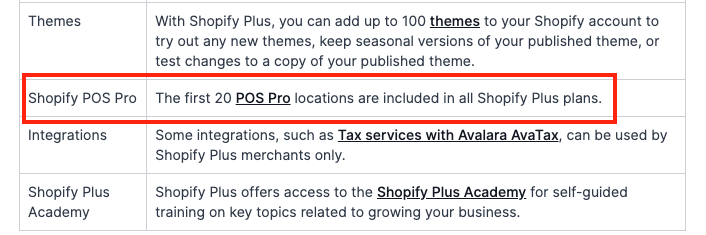

Businesses on Shopify’s enterprise-level plan, ‘Shopify Plus’, get access to 20 ‘POS Pro’ locations as part of their Shopify Plus subscription — this equates to a saving of around $19,000 per year on POS fees.

Shopify Plus businesses that need to use Shopify ‘POS Pro’ in more than 20 locations will face the standard $79-$89 per month fee for each additional ‘POS Pro’ outlet.

(You can learn more about the differences between Shopify Plus and the other Shopify plans in our detailed Shopify vs Shopify Plus comparison here.)

Shopify POS Pro credit card fees

At time of writing, the credit card fees for US merchants using ‘POS Pro’ in conjunction with Shopify Payments are as follows:

- Basic — 2.6% + 10¢ USD

- Grow — 2.5% + 10¢ USD

- Advanced — 2.4% + 10¢ USD

- Shopify Plus — 2.15% + $0.30

(If you’re based outside the US, different fees may apply — these vary by location).

As you can see, the credit card fees for in-person POS card payments on the ‘Basic,’ ‘Grow’ and ‘Advanced’ store plans are no different from the fees charged with ‘POS Lite’. It would be nice to see Shopify give ‘POS Pro’ users slightly more preferential rates in this regard.

If you use a third-party payment gateway, you’ll pay whatever their credit card processing fees are.

Important: Shopify Plus users should note that in addition to the 2.15% + $0.30 quoted above, Shopify charges an extra 0.2% per transaction if your store uses a third-party payment gateway.

Is Shopify POS Pro right for me?

For me, there is no doubt about it — if you’re serious about in-person selling for your Shopify business, the ‘POS Pro’ plan is well worth the investment.

Although the ‘POS Lite’ plan provides a pretty good range of POS features, the restriction on selling in multiple locations and with multiple staff members would definitely push me towards the Shopify ‘POS Pro’ plan.

Ultimately, Shopify ‘POS Pro’ is most useful for Shopify businesses that have one or several permanent retail outlets in addition to an online storefront.

It provides merchants with all the necessary POS functionality to operate large teams and attribute sales to staff members for commission or performance-analysis purposes. And significantly, it comes with more customer-centric features — including options to provide custom printed receipts and facilitate in-store pickup of goods purchased online.

You can learn more about Shopify ‘POS Pro’ here.

While you’re here, download our free ecommerce e-kit

For a limited time, we’re offering our readers some excellent free tools. Sign up free to immediately receive:

- our online store comparison chart

- a downloadable cheatsheet on how to create an online store

- our SEO, blogging and ‘how to start a business’ cheatsheets

- extended free trials and discount codes for essential business apps

- our latest tips on ecommerce and growing a business

Shopify POS hardware costs

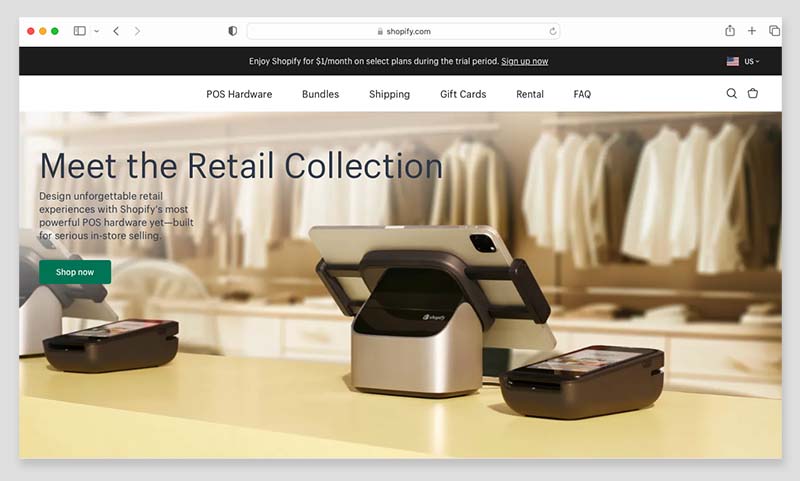

In addition to the POS software available on Shopify’s ‘POS Lite’ and ‘POS Pro’ plans outlined above, Shopify provides a wide range of POS hardware — card readers, barcode scanners, tills, receipt printers etc. — to help you sell in physical locations.

These are available from a Shopify’s dedicated POS hardware store.

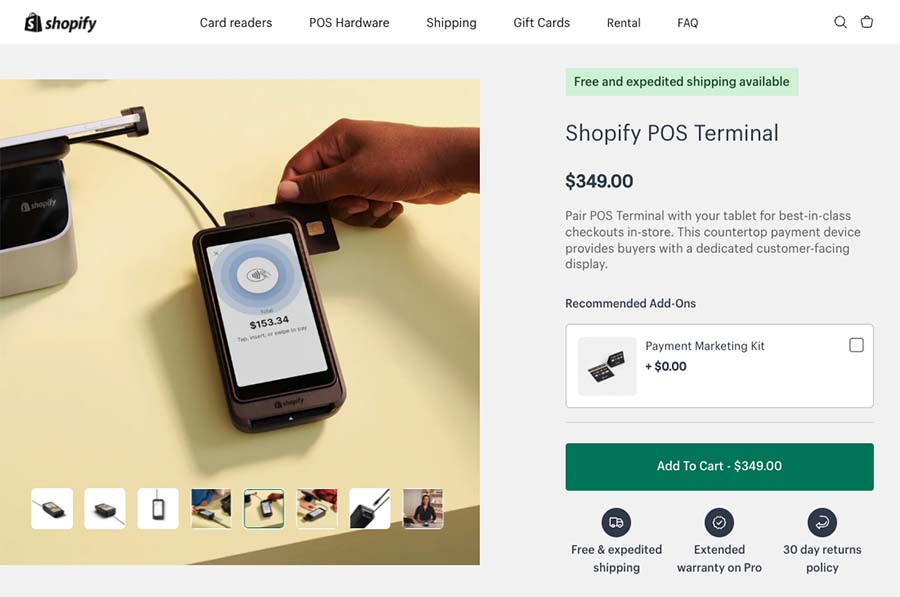

One particularly interesting feature in Shopify’s POS offering is its ‘POS Terminal‘ solution (costing $349), which provides a streamlined way to accept payments in physical retail settings.

This setup allows merchants to turn any computer into a fully functional payment terminal by connecting a Shopify card reader via USB. It supports tap, chip, and swipe payments from a wide range of popular payment cards (Visa, Mastercard, American Express, etc.) and digital wallets, including Apple Pay and Google Pay.

The ‘Virtual Terminal‘ integrates seamlessly with your Shopify account and works through the Shopify admin, ensuring that all sales and inventory data remain synced in real time. This makes it ideal for retail businesses that prefer a fixed point of sale without relying on wireless connectivity.

Some of the other POS hardware items available from Shopify (along with the relevant costs) are as follows:

- Tap & Chip card reader — $49

- Tablet stands — $149 to $185

- Barcode scanners — $199 – $289

- Barcode and label printers — $89 to $499

- Receipt printers — $249 to $499

- Labels and receipt paper — $19 to $109

- Cash drawers — $129 to $499

- Gift card sleeves — starting at $ 59 for 250 sleeves

These prices are broadly in line with similar POS devices from competing point-of-sale providers like Square and Lightspeed.

Similarly, when it comes to POS consumables like gift cards and receipt paper, the prices in the Shopify Hardware Store are generally in the same ballpark as other key POS competitors.

(For example, Shopify receipt paper is cheaper than Lightspeed’s, but more expensive than Square’s. When it comes to gift cards, Shopify charges less than Square for them, and about the same as Lightspeed.)

You can buy hardware directly from the Shopify Hardware Store in the following countries:

- Australia

- Belgium

- Canada

- Denmark

- Germany

- Finland

- Ireland

- Italy

- Netherlands

- New Zealand

- Singapore

- Spain

- United Kingdom

- United States

If you’re based outside a supported country, you can still use Shopify POS by purchasing compatible hardware from an authorized third-party retailer in your region.

Overall, Shopify’s POS hardware is well worth a look, especially if you sell regularly at events and markets, or if you sell in at least one permanent retail outlet.

The range of hardware on offer is really quite extensive, reasonably priced, and — most importantly for existing Shopify users — extremely well-integrated with Shopify’s ecommerce feature set.

Enhancing the Shopify POS system via third-party apps

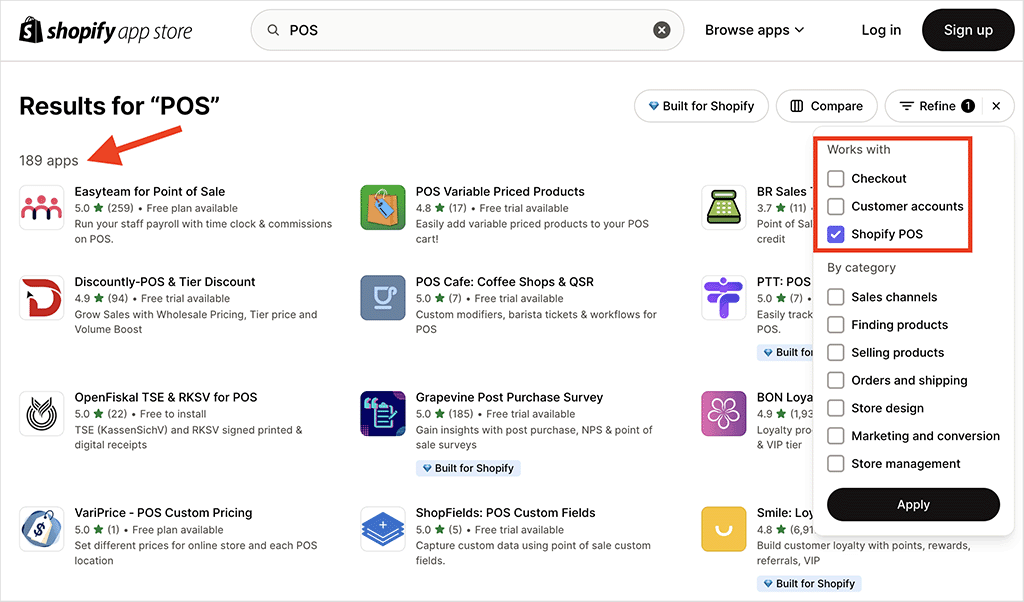

In addition to Shopify’s main ‘Shopify POS’ app, you can also add functionality to your Shopify POS operations by investing in a third-party app from the Shopify App Store.

There are currently around 189 apps that work with Shopify POS available — ranging from $5 all the way up to $599 per user per month in cost — and they provide a range of extra features to help with POS sales.

For example, you can buy apps that let you bulk print and send automated invoices; create custom product bundles for clients; or run customer surveys.

Examples of such apps include:

- Order Printer Pro, an app that lets you send fully-branded customizable invoices and receipts, create custom packing slips and automatically add invoice PDF links when a customer buys a product from your store at point-of-sale.

- Grapevine Surveys, an app that’s designed to let you conduct post-purchase customer surveys at multiple touch points.

Several of the available apps let you manage loyalty and rewards programs: for example, you can buy apps that let you create digital punch cards to reward repeat customers, or loyalty apps that let your customers add your store to their Apple and Google wallets.

Finally, the Shopify App Store also has several apps available that can be used to sell in-person appointments and classes.

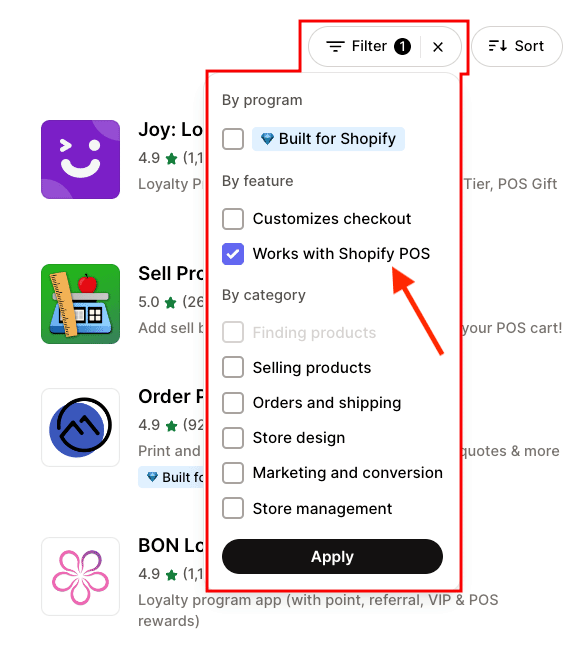

Tip: To find apps that work with Shopify POS, use the new Shopify App Store filters and tick the ‘Works with Shopify POS’ option.

Stocky app

Shopify ‘POS Pro’ users can avail of a free inventory management app developed by Shopify — the suitably named ‘Stocky’ app — that helps merchants streamline and optimize their inventory management process.

The ‘Stocky’ app lets you manage purchase orders and send messages to suppliers; conduct stock takes and perform stock adjustments; get product recommendations based on profit margins; and transfer stock between inventory locations.

You can learn more about managing inventory on the Shopify ‘POS Pro’ plan with the ‘Stocky’ app in the video below.

Alternatives to Shopify POS

While Shopify POS is undoubtedly the best POS option for Shopify store owners, it is not the only one available. Other big hitters include Lightspeed and Square.

In the case of Lightspeed, a direct integration is provided for syncing its POS features with Shopify’s ecommerce platform (but you’ll need to be on Lightspeed’s $179 ‘Core’ plan to be able to connect to Shopify).

However, unlike Shopify ‘POS Pro’ which charges you based on retail locations, Lightspeed POS fees are based on individual registers. This means you may end up paying quite a bit more than you would with Shopify POS if you want to equip each of your sales staff with a POS device.

Related resources: Shopify POS vs Square and Shopify vs Lightspeed.

If you have any questions on Shopify POS, please do leave them in the comments section below — we read all comments and will do our best to help.

Shopify POS Pricing FAQ

How much does Shopify POS cost?

Shopify POS can be used for free via the ‘POS Lite’ plan that is included with all Shopify store subscriptions — even Shopify’s $5 entry-level ‘Starter plan. However, for retailers in need of a professional POS package — i.e., one that lets you manage POS staff permissions, attribute sales to individual staff members and perform a host of other POS tasks like issue custom receipts and perform exchanges — Shopify’s ‘POS Pro’ plan is the more robust option. Pricing for Shopify ‘POS Pro’ is $89 per month if paying monthly or $79 per month when you pay upfront for a full year’s service.

Do I have to use Shopify POS as my POS system for Shopify?

No, you don’t. ‘Shopify POS’ is the official POS system developed by Shopify and is designed to integrate seamlessly with Shopify’s online store platform, but there are other third-party POS systems — such as Square and Lightspeed — that can be integrated with Shopify too.

Can I use Shopify POS as my my POS provider for other ecommerce platforms?

Technically yes, but it’s probably not worth it. If you use Shopify POS in conjunction with a store built in another platform like WordPress or Webflow you will face several sets of costs: your Shopify store subscription costs, your Shopify POS costs (if using ‘POS Pro’), as well as any fees associated with your ecommerce platform (WordPress hosting, Webflow ecommerce fees, etc.).

What percentage of each POS sale does Shopify take?

Shopify applies a credit card fee to each sale — with the exact percentage varying by country and Shopify plan. In the US, you will be charged 5% of each sale on the ‘Starter’ plan, 2.6% + 10c on ‘Basic,’ 2.5% + 10c on ‘Grow,’ 2.4% + 10c on ‘Advanced’ and 2.15% + 30c on ‘Shopify Plus.’

No comments