We have a strict honest review policy, but please note that when you buy through our links, we may receive a commission. This is at no extra cost to you.

In this Shopify POS vs Square POS comparison, we put two of the web’s most popular point-of-sale solutions head to head, and help you find out which one is better for your business.

In what follows, I’ll explore how Shopify POS and Square POS stack up in terms of:

- key POS features

- pricing plans

- hardware costs

and more!

Let’s dive straight in.

Shopify POS vs Square POS — key features

Both Shopify and Square offer a host of solid POS features to help you operate your business at a point of sale. Both platforms let you:

- accept in-person payments via a wide range of payment methods, including credit cards, mobile wallets, Apple Pay, Google Pay, Samsung Pay and Tap to Pay with iPhone

- create an online store and sync it with your POS system

- use a wide range of POS hardware

- manage and track inventory

- issue receipts to customers via print, email and text

- create discounts

- facilitate returns on goods

- cater for local delivery and local pickup of goods

- manage custom sales

- let you accept fixed and custom tip amounts

- create customer accounts for repeat purchases

- provide secure and encrypted payment processing that complies with ‘PCI’ card payment security standards.

In addition to the features above, which are available on Shopify’s bundled ‘POS Lite’ plan and Square’s ‘Free’ plan, both platforms also provide advanced POS functionality on their premium POS plans — Shopify’s ‘POS Pro’ plan and Square’s ‘Retail’ and ‘Restaurants’ plans.

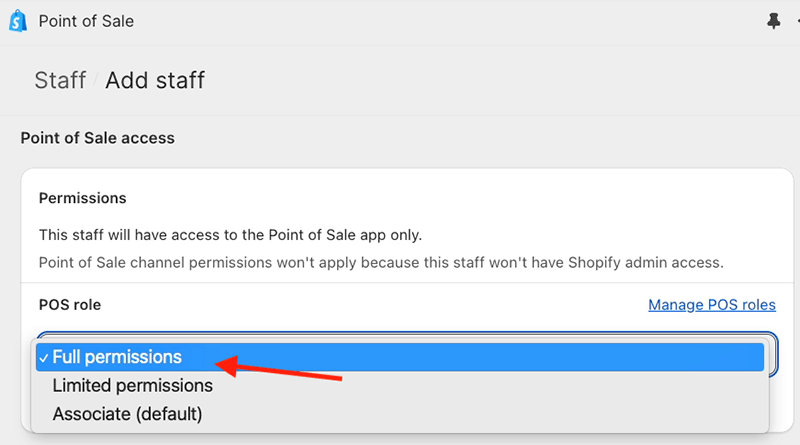

With both solutions, you’ll need one of these paid-for subscriptions if you want to:

- manage POS staff permissions

- create automatic purchase orders

- perform detailed inventory counts.

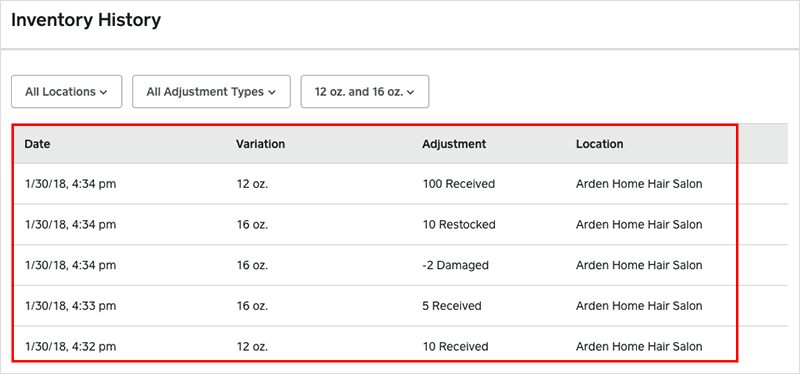

With Square, you’ll need one of its premium POS plans if you want to:

- access inventory history

- print barcodes

- receive stock forecasts

- create automatic purchase orders

- perform detailed inventory counts

- intake bulk inventory

- perform cross-location returns.

And you’ll need a Shopify ‘POS Pro’ plan in order to do any of the following:

- perform stock adjustments

- facilitate exchanges

- provide custom printed receipts

- create draft orders

- receive low stock reports

- save and retrieve customer carts.

Some of the key differences between Shopify POS and Square’s respective features are as follows:

- Shopify’ POS interface is more customizable than Square’s — although you can personalize the layout of Square’s POS software using a new tile-based system, Shopify POS gives you a ‘smart grid’ feature that provides considerably more options for creating a bespoke POS layout for your store. This can result in more streamlined workflows for your POS staff.

- Square POS lets you manage inventory across 300 different locations. But Shopify’s location limits are set to a maximum of 10 locations on its main plans (increasing to 200 locations on ‘Shopify Plus’ plans).

- Square lets you create an online store for free — You can create a functional online store for free with Square’s ‘Free’ online plan. However, it’s not possible to connect a custom domain to free Square stores, and they also feature prominent advertising on them.

- Shopify’s online store builder is significantly better than Square’s, beating it convincingly when it comes to store design, selling digital products, shipping options, abandoned cart saving, email marketing and international selling.

- Shopify offers 24/7 customer support on all of its paid plans. By contrast, on all but its most expensive plans, Square only gives you access to weekday customer support.

- Shopify POS can be used in a lot more countries than Square — Shopify can be used in over 175 countries worldwide, while Square works in just 8.

Pricing and Fees

Shopify POS Pricing

In order to use Shopify POS, you’ll need to have a Shopify subscription. There are five Shopify pricing plans to choose from:

- Starter — $5 per month

- Basic — $39 per month

- Grow — $105 per month

- Advanced — $399 per month

- Shopify Plus — custom pricing, but starting at $2,300 per month.

With the exception of Shopify Plus, you can try any of these plans out via a free trial. This normally lasts 3 days, but an extendable version (where you get an additional 3 months days for $1 per month) is available via this special link.

Now, there’s a couple of ways to reduce these fees. First, Shopify offers a 25% discount on the ‘Basic,’ ‘Grow’ and ‘Advanced’ plans if you pay for your first year’s service upfront — doing so brings the costs of these three plans down to $29, $79 and $299 per month respectively.

There’s also the option of using Shopify’s new ‘credits’ system to reduce costs — this lets you put 1% of your monthly sales towards the cost of your subscription. This initiative is a temporary one and not available everywhere — you can check availability in your country here.

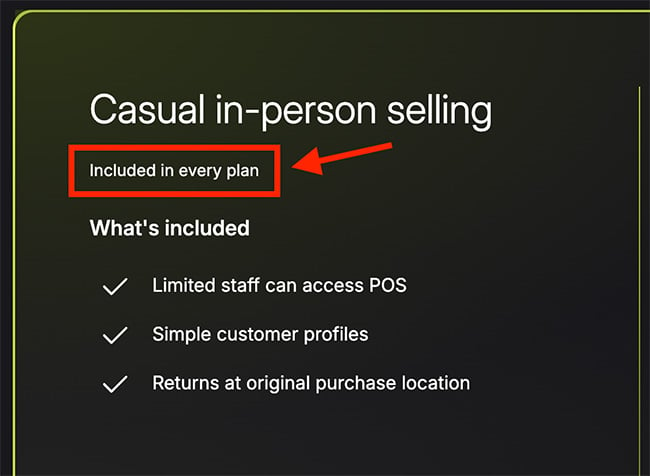

Once you’re equipped with one of the Shopify subscriptions listed above, you’ve got two Shopify POS plans to choose from: a ‘Casual in-person selling‘ plan and ‘Shopify POS Pro‘.

The good news is that the ‘‘Casual in-person selling‘ plan comes bundled with all Shopify store subscriptions, which means you can get going with Shopify POS from as little as $5 per month via Shopify’s ‘Starter’ plan.

However, if you would like more than one user to be able to log into your POS account, or work with more than two locations for managing inventory, you’ll realistically need to be on a ‘Basic’ Shopify store plan or higher.

Shopify’s ‘POS Pro‘ option — which lets you work with an unlimited number of POS staff, facilitate exchanges and provide custom printed receipts — costs $89 per month, per location when used with Shopify’s ‘Basic,’ ‘Grow’ and ‘Advanced’ Shopify plans.

(Users on Shopify’s enterprise-grade solution, Shopify Plus, get 20 POS Pro locations bundled with their plan).

However, an 11% discount on a ‘POS Pro’ subscription is available when you pay annually for your plan, which effectively reduces the monthly charge to $79 per month.

Shopify POS credit card fees

When you use Shopify POS to sell your products, you need to connect your account to a ‘payment gateway’ to process credit card transactions.

Shopify provides its own in-house payment gateway — ‘Shopify Payments’ — for just this purpose. It’s currently available in 39 countries, including the US, the UK, Australia, New Zealand, Canada, Hong Kong SAR, Japan and much of the EU.

In the US, when you use Shopify Payments to process in-person credit card sales with either the ‘Casual in-person selling’ plan’ or ‘POS Pro’, the following credit card fees apply to each sale:

- Starter — 5% + 0¢ USD

- Basic — 2.6% + 10¢ USD

- Grow — 2.5% + 10¢ USD

- Advanced — 2.4% + 10¢ USD

(More competitive rates are available in other countries).

These credit card fees will apply regardless of whether your customer pays with a physical credit card or via a tap payment (using Google Pay, Apple Pay, Samsung Pay etc.).

Now, it should be noted that Shopify POS doesn’t require you to using Shopify Payments as your credit card payment processor — it can also be integrated with a wide range of 300+ third-party payment gateways too.

This gives you the option to process payments in 175+ countries and to shop around for preferential rates for your business.

By contrast, using Square POS ties you in to using Square as your payment processor — there will be no third party gateways available to you.

So ultimately, Shopify offers a lot more flexibility for merchants when it comes to payment gateway providers.

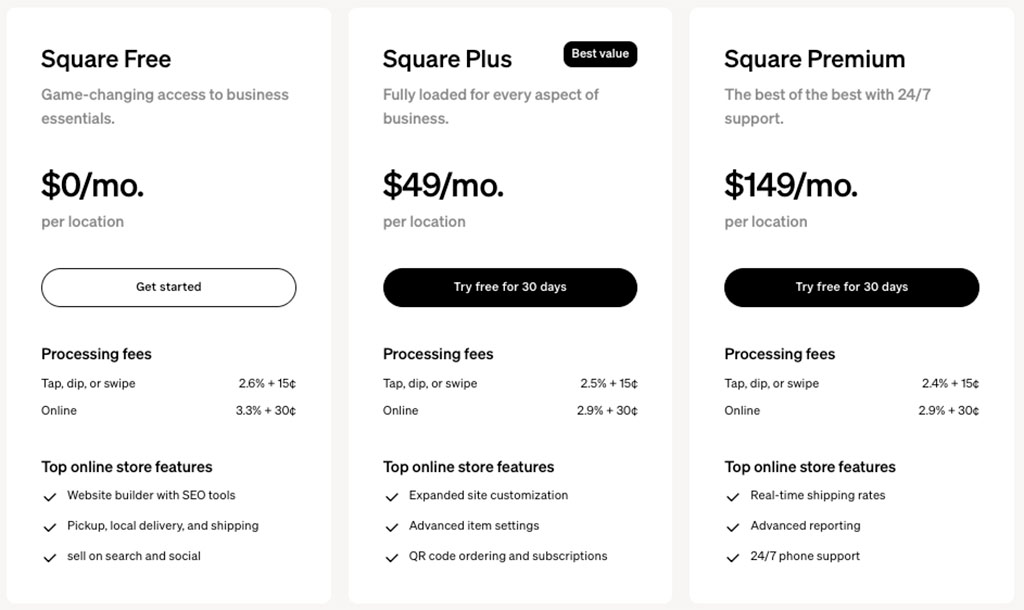

Square POS Pricing

Unlike Shopify, which requires you to subscribe to a monthly plan to access its POS system, Square gives you basic access to its POS system for free (so long as your annual sales remain below $250k). For most merchants, this represents the key advantage of using Square over Shopify.

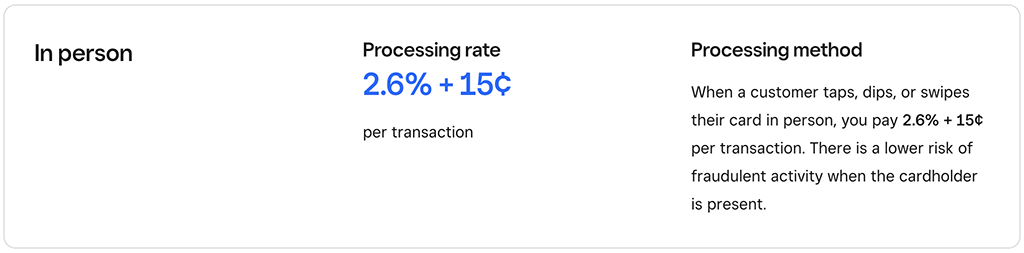

As for credit card fees, with the free version of Square these are 2.6% + 15 cents on every sale.

In addition to its free plan, Square also offers a lot of paid plans that give you advanced POS features and additional ecommerce capabilities.

Of these, many merchants will find Square’s ‘Advanced Access’ add-on plan particularly useful. This starts at $35 per month per location and can be used in conjunction with the free version of Square POS. It lets you set staff POS permissions, create staff badges and access advanced reports on your POS team performance.

Some of Square’s other paid plans are listed below:

Square Online storefront

- Free — $0 per month

- Plus — $49 per month

- Premium — $149 per month

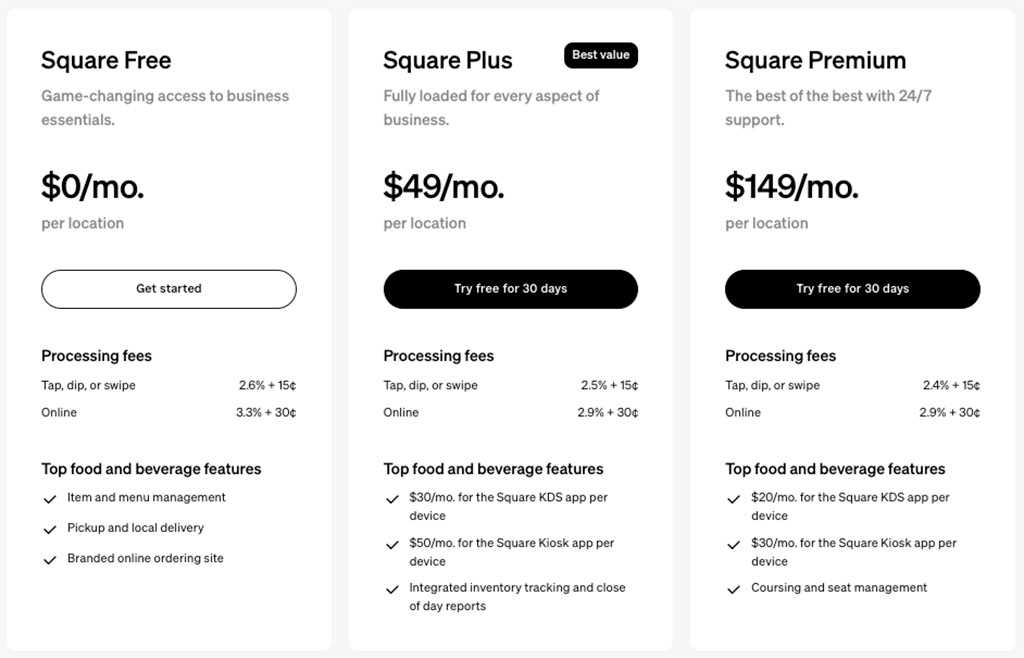

Restaurant POS software

- Free — $0 per month

- Plus — $49 per month per location

- Premium — $149 per month per location

Retail POS software

- Free — $0 per month

- Plus — $49 per month per location

- Premium — $149 per month per location

Customer loyalty software

- 0 – 500 loyalty visits — $45 per month

- 500 – 1,500 loyalty visits — $75 per month

- 1,501 – 10,000 loyalty visits — $105 per month

Payroll software

- Pay contractors — $6 fee per person paid

- Pay employees — $35 per month plus $6 fee per person paid.

It’s worth pointing out that Square’s ‘Retail’ and ‘Restaurant’ paid plans provide slightly more favorable credit card fees than the free versions — 2.6%+ 10 cents per sale rather than 2.6% + 15 cents per sale.

Restaurant owners should also note that Square’s $60 per month ‘Plus’ plan only lets you use one countertop POS device per location — using additional Square POS registers cost $50 per device (there is also an additional $50 per month charge for restaurant locations using Square mobile POS for their floor staff).

By contrast, Shopify’s ‘POS Pro’ plan lets you use as many devices as you like in each POS location without any additional charges being involved.

So which is cheaper, Shopify POS or Square POS?

Well, when it comes to getting started with point of sale in a cost-efficient way, Square wins. This is because it lets you use its POS system for free, while using Shopify always involves subscribing to a paid-for plan.

This makes Square a very affordable option for small businesses that are focused on in-person sales — there are no upfront expenses involved with using it and the only costs that you have to worry about are credit card fees.

However, Shopify has a bit of an edge over Square if you want to connect your POS system to an online store on a custom domain.

Doing so with Square requires a $49 per month Square Online ‘Plus’ plan; while Shopify lets you do this on its ‘Basic’ plan, which costs $20 per month (if paying annually).

However, the online store functionality that you get with Shopify is considerably stronger — its store design, marketing, checkout and international selling features are all light years ahead of what’s available from Square.

(You can find out why in my full Shopify vs Square comparison).

The bottom line here is that if you only envisage yourself selling in physical locations, and you’re on a low budget, there’s a lot to be said for using Square — simply because you can get going with it for free (but watch out for the additional countertop device costs!).

However, if you’re intending to run an online store and a POS system in conjunction with each other, the hands down winner is Shopify — it gives you much better bang for your buck.

You’ll find a summary of Square POS vs Shopify POS pricing in the table below:

| Shopify POS | Square POS | |

| Monthly POS subscription | $0 — $89 per month | $0 — $149 per month |

| Additional countertop devices | No additional charge | $50 per extra device (Square for Restaurants plan) |

| Using mobile POS for floor staff | No additional charge | $50 per month per location |

| Monthly ecommerce store subscription | $5 — $399 | $0 — $149 |

| In person credit card fees | 2.4% + 10 cents — 2.6% + 10 cents per transaction | 2.5% + 10 cents — 2.6% + 15 cents |

| Online credit card fees | 2.5 + 30 cents — 2.9% + 30 cents per transaction | 2.9% + 30 cents per transaction |

| Tap to Pay with iPhone fee | 2.4 + 30 cents — 2.9% + 30 cents per transaction | 2.6% + 15 cents per transaction |

Don’t miss out — download our free Shopify Startup Kit

Our free Shopify Startup Kit is a must for anyone thinking of building an online store with Shopify. Containing a comprehensive e-book on starting a Shopify store, video tutorials, PDF cheatsheets and much more, it’s packed full of practical advice on how to get a Shopify business off the ground. It’s available for free to Style Factory readers — but for a limited time only.

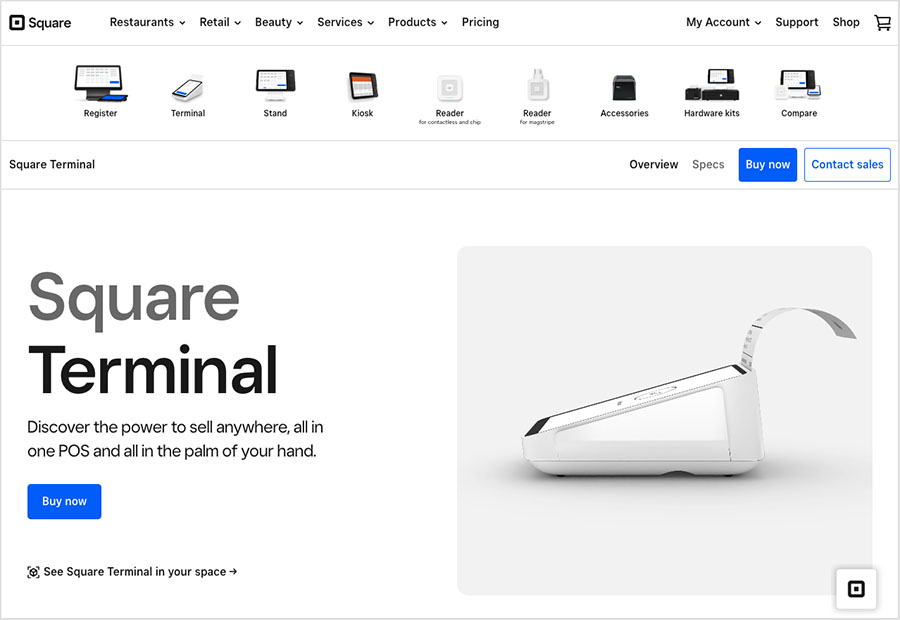

POS hardware

Both Square and Shopify let you use a good range of POS hardware — card readers, barcode scanners, tills, receipt printers etc. — to help you sell in physical locations. These are available from both companies’ respective hardware stores.

Square has an immediate advantage over Shopify when it comes to accessing basic POS hardware. This is because all Square users can get their hands on a free magstripe card reader worth $10 from the company when they sign up for an account.

(Shopify users will always have to purchase POS hardware).

Another plus point of Square’s POS hardware offering is that it lets you buy a dual-display register device (one display for the salesperson and another for the customer).

Shopify doesn’t yet have a comparable product on offer — instead, you’ll have to use an iPad or Android tablet as your register screen when selling at point of sale.

In terms of the pricing for POS hardware essentials, the two companies are fairly evenly matched.

For example, a contactless card reader will set you back $59 with Square, and $49 with Shopify; and a bluetooth barcode scanner costs $299 from both companies.

As for pricing for the two companies’ flagship POS hardware devices, ‘Square Terminal’ and ‘Shopify POS Terminal’ respectively, these are similarly priced. ‘Square Terminal’ costs $299, or $349 if you want to use it with a wired connection; ‘Shopify POS Terminal’ costs $349.

One thing to note here is that Shopify’s device can only be used as a wired device. If you want to do wireless handheld selling, you’ll need to resort to ‘Tap to Pay’ on an iPhone.

Here’s a table giving a side-by-side comparison on POS hardware costs from Shopify and Square.

| POS hardware device | Shopify POS | Square POS |

| ‘All-in-one’ POS terminal | $349 | $299 (handheld) / $349 (wired) |

| Card reader | $49 | $59 |

| Integrated cash register | None (iPad or tablet only) | $799 |

| POS device stands | $149 — $185 | $149 |

| Barcode scanners | $269 — $289 | $119 – $249 |

| Barcode and label printers | $119 — $499 | $299 — $549 |

| Receipt printer paper | $29 for 10 rolls | $29 for 20 rolls |

| Cash drawers | $129 — $139 | $129 — $549 |

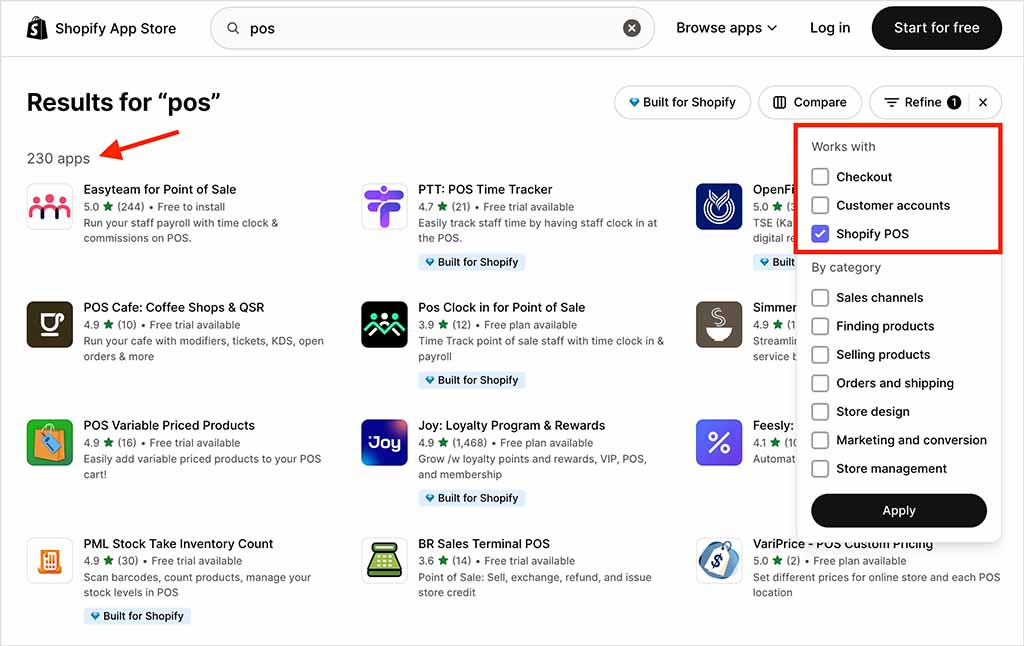

Extending your POS via apps

Shopify POS is a clear winner over Square POS when it comes to extending the possibilities of point of sale via apps and integrations. Its overall app ecosystem contains 16,000+ apps, dwarfing the equivalent offering from Square, which has a much slimmer portfolio of around 450 apps.

With regard to apps that focus exclusively on point of sale, I counted 1,000+ POS apps in the Shopify app store, 230 of which were specifically designed to extend the capabilities of Shopify POS.

Examples of the extra functionality provided by these apps include appointment scheduling, loyalty program provision, product bundling and bespoke pickups of products.

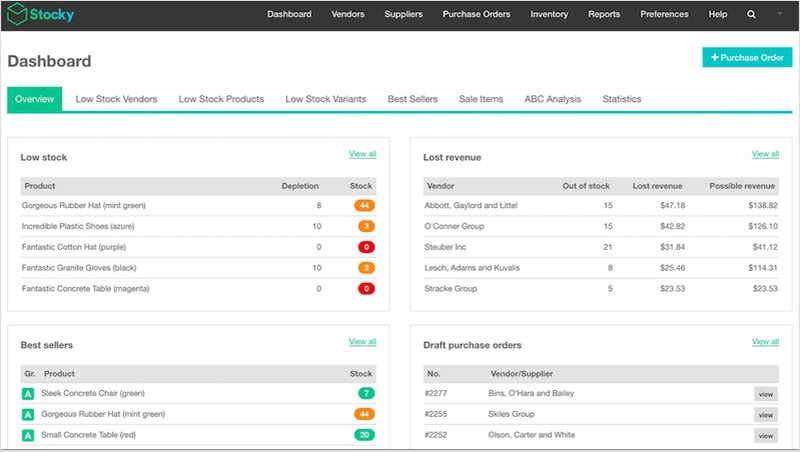

Worth a particular mention however is the Shopify-made ‘Stocky’ app, which is available to users with a ‘POS Pro’ subscription. This lets you add quite a bit of functionality to the native Shopify POS features.

You can use Stocky to manage purchase orders and send messages to suppliers; conduct stock takes and perform stock adjustments; get product recommendations based on profit margins; and transfer stock between inventory locations.

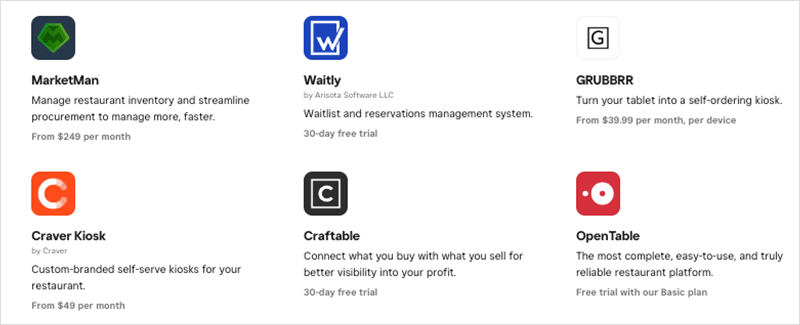

Square’s app offering for extending its POS capabilities is significantly smaller — my search for the term ‘POS’ in Square’s app library surfaced around 250 apps.

Now, it’s worth noting that a particularly large number of Square’s POS apps are focused on providing features to food and dining businesses.

This reflects the fact that Square generally tailors its app offering to very specific industry sectors. For example, there’s a POS app available for running a flower shop; another for running a jeweller’s; and several designed for use by repair shops.

The table below spells out the quantities of apps available from both Shopify and Square to cater for specific POS tasks.

| Shopify POS | Square POS | |

| Total apps available | 16,000+ | 450+ |

| POS apps | 1,500+ apps available | 250+ apps available |

| Inventory management apps | 1,000+ apps | 90+ apps |

| Staff POS apps | 600+ apps | 220+ apps |

| Customer loyalty apps | 500+ apps | 60+ apps |

| Pickup apps | 500+ apps | 40+ apps |

User reviews

To give you an idea of how users rate each platform, the table below summarises feedback from popular software review sites.

| Review site | Shopify POS | Square POS |

| Capterra | 4.6/5 | 4.6/5 |

| GetApp | 4.6/5 | 4.6/5 |

| Sourceforge | 5/5 | 5/5 |

| G2 | 4.4/5 | 4.7/5 |

| Average score (out of 5) | 4.65 | 4.73 |

User reviews of both Shopify POS and Square POS are extremely positive, with Square holding a very slight edge overall (4.73 vs 4.65). But in practice, there’s almost nothing between the two platforms in terms of customer satisfaction.

Conclusion

If your sole aim is to sell goods in person (and you don’t need an online store), then of the two platforms here, I’d argue that Square is the better option. Its POS system is easy to use, takes care of the key tasks and can be used without a monthly subscription.

Square is also the winner if you’re looking for a POS system for a restaurant or food business. Its ‘Square for Restaurant’ POS subscription is purpose-built for the restaurant sector, providing excellent features for table management, creating menus, customer ordering and managing restaurant floor plans.

However, if you want to run both an online store and a POS system, then Shopify is unquestionably the better platform. It lets you create much more bespoke and sophisticated online stores than Square, and it gives you a lot more options to expand your online and in-person sales via its massive range of apps and integrations.

Shopify’s POS interface is also more customizable than Square’s. While Square allows for layout personalization through a new tile-based system, Shopify POS software’s ‘smart grid’ feature gives you significantly more options for designing a custom POS layout tailored to your store.

Below you’ll find my lists of the key reasons why you might pick one of these platforms over the other; and if you’d like to learn more about how Shopify and Square compare in even more detail (and especially from an ‘online store building’ point of view) please check out our full Shopify vs Square platform comparison.

If you’d like to try either tool out, you can access trials of both using the following links:

Finally, if you have any thoughts or questions on Square or Shopify POS, please do leave them in the comments section — we read them all and will do our best to help.

Pros and cons of Shopify POS vs Square POS

Reasons I’d choose Shopify POS over Square POS

- Shopify POS can be used in many more countries than Square.

- It gives you a lot more payment gateway options.

- Its POS interface is more customizable than Square’s.

- Shopify online stores are far better from a functionality point of view than Square’s.

- Shopify’s customer service is more comprehensive.

- The Shopify POS app is available in more languages.

- Shopify’s enormous app store gives you far more options for adding POS functionality than Square’s.

Reasons I’d choose Square POS over Shopify POS

- Unlike Shopify, Square can be used for free.

- It provides a more extensive POS hardware offering.

- Square lets you manage inventory across more locations.

- It’s better for restaurant businesses thanks to its custom-made software for the food and beverage sector.

At-a-glance feature comparison

| POS feature | Shopify POS | Square POS |

| Payment gateways | 105+ | 1 |

| Payment processing availability | 39 countries with Shopify Payments; 175+ countries via third-party payment providers | 8 countries |

| Inventory locations | Up to 10 locations on most Shopify plans; up to 200 on ‘Shopify Plus’ | Up to 300 on paid Square plans |

| POS layout customization | Excellent | Good |

| POS Reporting | Excellent | Good |

| Hardware devices | Excellent | Excellent |

| Exchanges | Available on paid plan only | Included with free plan |

| POS staff permissions | Available on paid plan only | Available on paid plan only |

| Discounts | Available on free plan | Available on free plan |

| Supported languages on mobile app | 20 languages | 5 languages |

| Customer support | 24/7 on all paid plans | Monday to Friday on most paid plans |

| Free trial | 3 days (extendable via $1/mo for three months of service) | Free plan |

Update details

This article was updated on 30 September 2025. The following updates were made:

- A user reviews section was added.

- Shopify POS plan names were updated.

- Product screenshots were updated.

- POS hardware pricing was updated.

- The number of countries supported by Shopify Payments was been updated.

- The numbers of apps available for both products were updated.

No comments